GOV.UK Pay

The GOV.UK Pay product marketing homepage – selling the benefits of GOV.UK Pay to delivery teams in the public sector

Making it easier for citizens and businesses to pay government

Most people have to pay government money at some point or another. For example, when you pay tax, renew your passport, get a new driver’s licence, or pay for visa applications.

Before GOV.UK Pay was launched government services used a range of different payment providers. Each one offered a jarring and often inaccessible payment experience for users. GOV.UK Pay gives users a seamless, accessible and trusted payment experience using the GOV.UK design language.

Flow diagram highlighting potential payment routes that could be available to users

The team synthesising user insights after multiple rounds of usability testing Direct Debit journeys

The accessible GOV.UK Pay user facing card payment screens

Inline error messages that help users diagnose problems with the details they entered. These descriptive error messages supported users less comfortable with paying for things online.

Unlocking the long tail of government services with payment links

The payment links feature enables service teams with no digital capabilities to take payments online in a matter of minutes. Just by inputting a few simple payment parameters within the admin tool they can then publish a live page on GOV.UK and start taking payments. Services can send customers the payment link via email or issue it on paper forms. This feature has saved government a lot of money in manual payment processing.

The admin tool showing initial payment parameters being set and the accompanying start page that is published on GOV.UK

Video showing payment links in action

Making it cheaper and easier for public services to reconcile payments, provide user support, and issue refunds

Managing the reconciliation of payments across multiple payments types, such as cards, direct debit and e-wallets, is a complex process that involves many manual steps. Providing one reporting interface that shows all payment types and providers makes this process more efficient.

GOV.UK Pay provides detailed and timely transaction information that helps government call centres keep citizens better informed about the status of their payments. This more accurate information helps reduce government costs of running these call centres.

Public sector organisations issue millions of refunds to citizens each year, GOV.UK Pay makes this process more efficient and secure. Instead of refunding payments via time consuming manual processes, it is becoming standard to issue full or partial refunds directly to the cards used to make the original payments. That’s not just more user-friendly, it also helps prevent fraud.

Screens from the GOV.UK Pay admin tool. The second image shows how a service can easily adjust the payment methods shown to users.

GOV.UK Pay staff facing admin tool showing account dashboard and transaction list

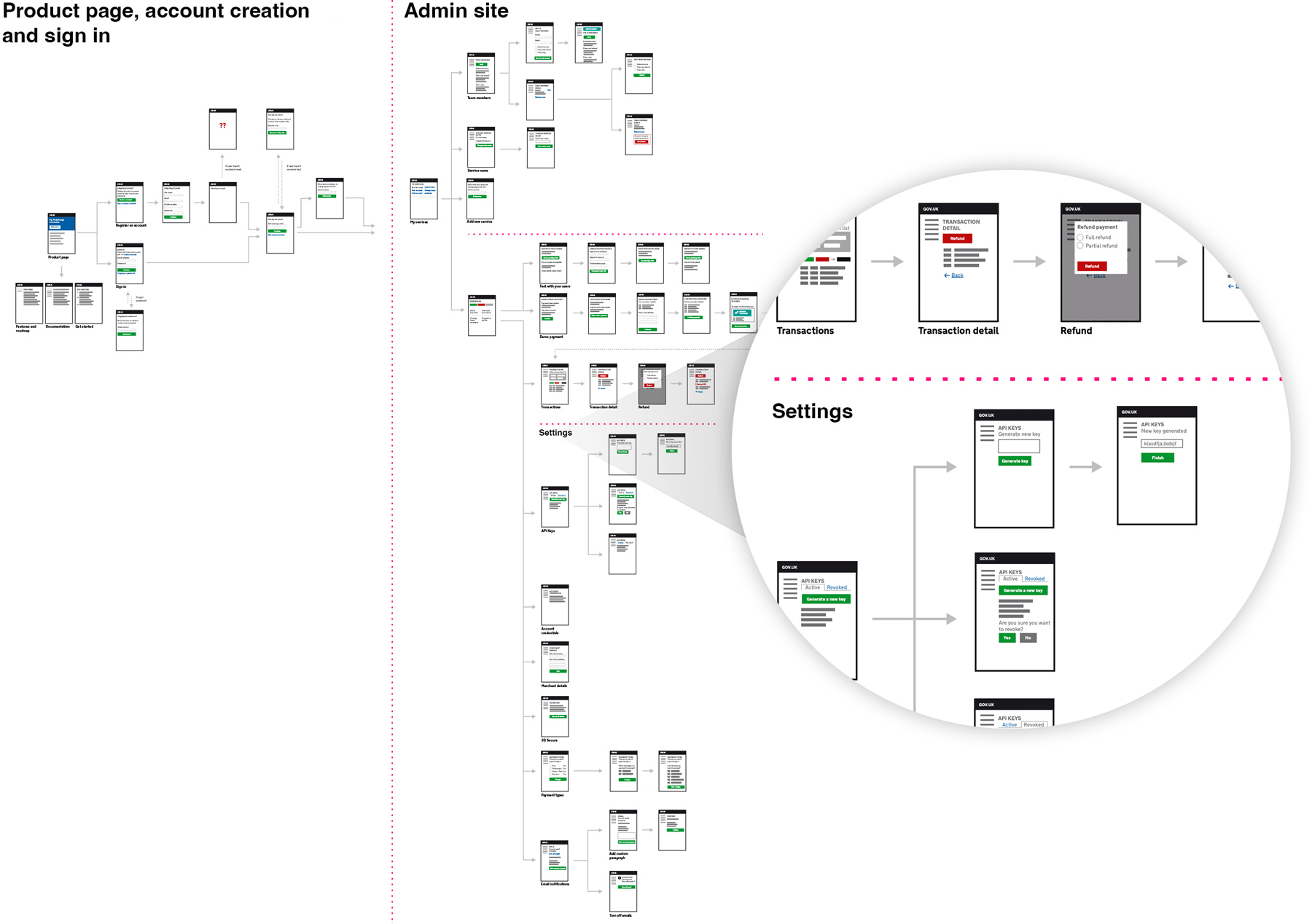

Overview of the GOV.UK Pay admin tool user journeys

Creating a better experience for developers and teams building public services

Public sector digital services often need to accept payments. The teams building those services have to procure and integrate a new payments system - which takes time.

With GOV.UK Pay, service teams don't have to worry about this responsibility because GOV.UK Pay does the heavy lifting in this regard. Government services integrate with our platform through simple APIs we’ve developed. Developers and service owners can trial the platform in a sandbox environment. This allows them to test the frontend payment user journey, the backend financial tracking functionality, and test how it integrates with their existing systems.

Using GOV.UK Pay makes it quicker and cheaper for the government to launch new services, since it avoids unnecessary repetition of the same procurement and integration work every time.

GOV.UK Pay technical documentation